Unveiling the Strategic Value of CGC 10 Japanese Vintage & Holo Rares in Modern Collecting

In the intricate landscape of Pokémon card investments, CGC 10 Japanese vintage and holo rares occupy a distinct niche that blends scarcity, cultural significance, and grading precision. These cards are not merely collectibles; they are financial assets underscored by the stringent CGC grading standards that highlight condition and authenticity, essential for discerning investors targeting the Japanese market segment. Understanding the nuanced differences between CGC Pristine 10 and Gem Mint 10 grades, and how they affect market valuation, provides critical insight for strategic acquisition.

Key Criteria for Selecting Top CGC 10 Japanese Vintage & Holo Rares

To optimize investment outcomes, one must evaluate rarity, historical print runs, and holofoil condition under CGC’s exacting grading methodology. Cards from the Base Set and early expansions, particularly those with minimal print quantities and holofoil effects, demonstrate superior appreciation trajectories. The intersection of popularity and scarcity, such as the iconic Japanese Charizard or rare promo editions, forms a cornerstone of high-yield portfolios. Moreover, understanding CGC’s grading nuances through decoding CGC standards for Japanese Pokémon cards is indispensable for accurate valuation.

How Do CGC 10 Japanese Vintage Holo Rares Compare in Long-Term Investment Stability?

Expert discourse often revolves around the comparative stability of Japanese CGC 10 holo rares against their English counterparts. Japanese cards, benefiting from limited domestic print runs and a collector base that prioritizes pristine condition, often exhibit superior resilience to market volatility. Moreover, holo rares graded CGC 10 maintain premium valuations due to the rarity of flawless holofoil surfaces and sharp centering metrics. This contrasts with English cards, which, despite broader market appeal, can suffer from overproduction and variable condition standards. These dynamics are well documented in collector forums and specialized market analyses, such as those published in Collectors Weekly’s grading market insights.

Advanced Investment Picks: Top 10 CGC 10 Japanese Vintage & Holo Rares to Acquire

Identifying the ten most promising cards requires an intersectional approach combining CGC grading data, auction performance, and cultural resonance. Notable examples include the Japanese Base Set Charizard 4/102 (holo), Pikachu Illustrator promo, and rare Trainer Secret Rares. Each card’s investment potential is amplified by its CGC 10 certification, which assures collectors and investors of maximal condition and authenticity. For a comprehensive guide on these key cards, see Top Investment Picks CGC 10 Japanese Vintage Holo Rares.

Integrating CGC 10 Japanese Card Investments into a Diversified Portfolio

Given the collectible market’s inherent volatility, integrating CGC 10 Japanese vintage and holo rares requires balancing risk through diversification across card types, eras, and grading nuances. Strategic acquisition should also consider market timing and liquidity factors, with platforms like eBay providing both buying opportunities and price transparency. For investors seeking to navigate this complex space, resources such as Where to Find CGC Gem Mint 10 Japanese Pokémon Cards on eBay offer essential market entry points.

Call to Action: Elevate Your Expertise in Japanese Pokémon Card Investments

To further refine your investment strategy with CGC 10 Japanese vintage and holo rares, explore our detailed analyses and market trend reports available on our platform. Engage with our expert community to share insights and stay ahead of emerging opportunities by visiting Exploring Investment Potential of CGC 10 Japanese Vintage Holo Cards.

Unpacking Market Dynamics: Why CGC 10 Japanese Cards Outperform in Niche Collecting Segments

While CGC 10 Japanese vintage and holo rares are universally acclaimed for pristine condition, their market performance is deeply influenced by collector psychology and regional demand. The exclusivity of Japanese print runs, combined with CGC’s rigorous grading, creates a scarcity premium that often outstrips English card equivalents. Collectors prioritize condition and cultural authenticity, making CGC 10 Japanese holo rares an asset class that benefits from both intrinsic and extrinsic value drivers. Understanding these nuances empowers investors to anticipate market trends and capitalize on emerging demand fluctuations.

Applying Advanced Grading Analytics to Predict CGC 10 Card Value Trajectories

Integrating data analytics with grading reports can significantly enhance predictive accuracy for card valuation. By analyzing auction results and grading distribution curves, investors can identify rare variants with outsized appreciation potential. For example, cards exhibiting consistently high CGC 10 populations but limited market availability signal strong demand and supply imbalance. Tools such as grading trend dashboards and historical price indices serve as indispensable assets for collectors aiming to optimize timing and selection. This approach is elaborated in the authoritative analysis by Beckett Grading Services, which highlights grading impact on Japanese card valuations (Beckett Grading Insights).

How Can Collectors Leverage CGC 10 Japanese Trainer Secret Rares to Unlock Hidden Portfolio Growth?

Trainer Secret Rares, often overshadowed by iconic Pokémon cards, represent an underexploited segment with substantial upside. Their rarity, combined with CGC 10 grading, assures collectors of exceptional condition and authenticity, driving incremental value growth. Strategic acquisition of these cards supports portfolio diversification and taps into a niche collector base focused on competitive play and artistic rarity. Mastering grading subtleties specific to Trainer Secret Rares, such as centering and edge sharpness, is crucial for maximizing value realization. For an in-depth exploration, see Mastering CGC 10 Japanese Full Art Trainer Secret Rare Insights.

Strategic Alliances and Marketplaces: Maximizing CGC 10 Japanese Card Acquisition and Sales

Successful collectors and investors recognize the importance of leveraging trusted marketplaces and expert networks to source and liquidate CGC 10 Japanese cards efficiently. Platforms offering verified CGC 10 cards, combined with transparent pricing histories, reduce risk and enhance liquidity. Collaboration with grading experts and seasoned collectors facilitates access to exclusive lots and early market intelligence. Integrating these relationships with e-commerce channels like where to find CGC Gem Mint 10 Japanese Pokémon cards on eBay empowers investors to execute timely trades and optimize portfolio turnover.

Call to Action: Join the Vanguard of Japanese Pokémon Card Investment Excellence

Elevate your collecting strategy by joining our expert community, where nuanced grading insights and market analytics converge. Share your experiences or inquire about specialized card segments by visiting our Contact Us page. Together, we can navigate the evolving landscape of CGC 10 Japanese vintage and holo rares for sustained investment success.

Decoding the Intricacies of CGC 10 Grading Metrics for Japanese Pokémon Cards

CGC’s grading system transcends mere surface-level evaluation by integrating microscopic inspection of centering precision, edge wear, surface gloss, and holofoil integrity. For Japanese vintage and holo rares, the grading process incorporates heightened scrutiny of subtle print variances and potential restoration traces that can affect the pristine status. Unlike some grading services that rely heavily on visual inspection alone, CGC employs advanced imaging technology to detect anomalies invisible to the naked eye. This meticulous approach ensures that a CGC 10 rating is not just a nominal label but a robust certification of near-perfect condition, which significantly impacts market demand and pricing.

Leveraging Predictive Analytics to Anticipate CGC 10 Japanese Card Market Fluctuations

Advanced investors increasingly rely on AI-driven predictive models that analyze historical auction data, grading distributions, and macroeconomic indicators affecting collectible hobbies. By incorporating seasonal trends, such as peak interest during Pokémon anniversaries or major game releases, these models forecast price trajectories with increasing accuracy. Specifically, CGC 10 Japanese cards benefit from such analysis due to their limited supply and high desirability among discerning collectors. These tools enable investors to strategically time acquisitions and dispositions, optimizing portfolio returns. For further insights on predictive methodologies, Beckett Grading Insights offers a comprehensive breakdown of grading’s impact on valuation.

What Are the Most Critical Variables Affecting the CGC 10 Grade Stability Over Time?

Grade stability is influenced by factors such as environmental storage conditions, handling during display or transport, and market re-examinations prompted by evolving grading standards. Collectors should be aware that while a CGC 10 grade denotes a snapshot of condition at grading time, external variables can affect a card’s long-term preservation and resale value. Additionally, technological advancements in grading might lead to retrospective re-evaluations, which underscores the importance of choosing reputable grading firms and maintaining optimal card care practices.

Integrating CGC 10 Japanese Cards into Algorithmic Portfolio Models for Collectibles

Modern portfolio theory applied to collectibles necessitates the quantification of risk and return characteristics unique to graded cards. CGC 10 Japanese vintage and holo rares, due to their scarcity and authenticated quality, often exhibit lower volatility compared to ungraded or lower-grade counterparts. Incorporating these assets into diversified collectible portfolios can enhance overall risk-adjusted returns. Algorithmic models that factor in rarity indices, grade distributions, and liquidity metrics offer sophisticated frameworks for asset allocation. Investors leveraging these models can better navigate market cycles and capitalize on arbitrage opportunities between different grading platforms and marketplaces.

Expanding Market Access: The Role of Blockchain and NFTs in Japanese Pokémon Card Provenance

The advent of blockchain technology introduces a transformative layer in provenance verification and fractional ownership for high-value CGC 10 Japanese cards. Tokenization on decentralized ledgers enables immutable recording of grading certificates, transaction histories, and ownership transfers. This innovation mitigates forgery risks and enhances liquidity by facilitating fractional investments. Early adoption of blockchain-backed marketplaces is poised to redefine collector engagement and unlock new capital inflows into the Japanese vintage card segment. Stakeholders should monitor emerging platforms to stay ahead in this evolving ecosystem.

Call to Action: Dive Deeper into the Fusion of Grading Science and Market Intelligence

To harness the full potential of CGC 10 Japanese vintage and holo rares, immerse yourself in advanced grading analytics and market trend research. Join our expert forums and subscribe to tailored alerts that decode evolving grading standards and investment signals. Visit Exploring Investment Potential of CGC 10 Japanese Vintage Holo Cards to elevate your collecting strategy with cutting-edge insights.

Blockchain-Enhanced Provenance: Securing Authenticity Beyond Traditional Grading

The integration of blockchain technology with CGC 10 Japanese vintage and holo rare Pokémon cards represents a paradigm shift in provenance verification and market transparency. By embedding immutable grading certificates and transaction histories into decentralized ledgers, blockchain mitigates the risks of forgery and grade tampering that have historically plagued high-value collectibles. This innovation not only reinforces investor confidence but also facilitates fractional ownership models, allowing broader participation in premium card assets. Moreover, smart contracts enable automated royalty distributions on secondary sales, aligning incentives across collecting communities and further bolstering market liquidity.

Augmenting Investment Decisions Through AI-Driven Market Sentiment Analysis

Beyond traditional grading analytics, cutting-edge investors are leveraging artificial intelligence to mine social media sentiment, forum discussions, and auction chatter related to CGC 10 Japanese cards. Natural language processing algorithms quantify collector enthusiasm and emerging trends, providing predictive signals that complement quantitative auction data. This multidimensional approach enables portfolio managers to anticipate demand surges or downturns with greater precision, optimizing buy and sell timing. Coupled with real-time pricing dashboards, AI-driven sentiment analysis catalyzes informed decision-making in an increasingly dynamic market ecosystem.

What Are the Emerging Risks and Opportunities When Combining Blockchain Provenance and AI Analytics in CGC 10 Pokémon Card Investments?

While blockchain ensures secure and transparent provenance, it introduces challenges such as platform interoperability, user adoption hurdles, and regulatory uncertainties surrounding digital asset tokenization. Concurrently, AI analytics depend heavily on data quality and algorithmic biases, which can skew market forecasts if unchecked. However, the synergistic application of both technologies unlocks unprecedented opportunities for enhanced asset security, liquidity, and predictive accuracy. Early adopters who navigate these complexities stand to gain competitive advantages by accessing novel investment vehicles like tokenized card fractions and sentiment-driven arbitrage strategies. Continuous monitoring of technological developments and regulatory frameworks is imperative to mitigate risks and capitalize on these innovations.

Collaborative Ecosystems: Building Strategic Partnerships to Leverage Technology-Driven Investment Models

Maximizing the benefits of blockchain and AI analytics requires forging alliances among grading authorities, technology providers, and seasoned collectors. Collaborative platforms that integrate CGC certification data with blockchain provenance and AI market insights foster a cohesive ecosystem that streamlines verification, valuation, and trading processes. These partnerships facilitate access to exclusive investment opportunities, including pre-auction consignments and private sales of CGC 10 Japanese holo rares. Furthermore, community-driven governance models empower stakeholders to influence platform evolution, ensuring alignment with collector interests and market integrity.

Call to Action: Engage with the Frontier of CGC 10 Japanese Pokémon Card Investment Innovation

To stay at the vanguard of Pokémon card investment excellence, immerse yourself in the convergence of blockchain provenance and AI-powered market analytics. Explore detailed case studies and participate in expert-led webinars by visiting Exploring Investment Potential of CGC 10 Japanese Vintage Holo Cards. Join our community to unlock advanced strategies and access emerging technology-driven marketplaces that redefine collectible asset management.

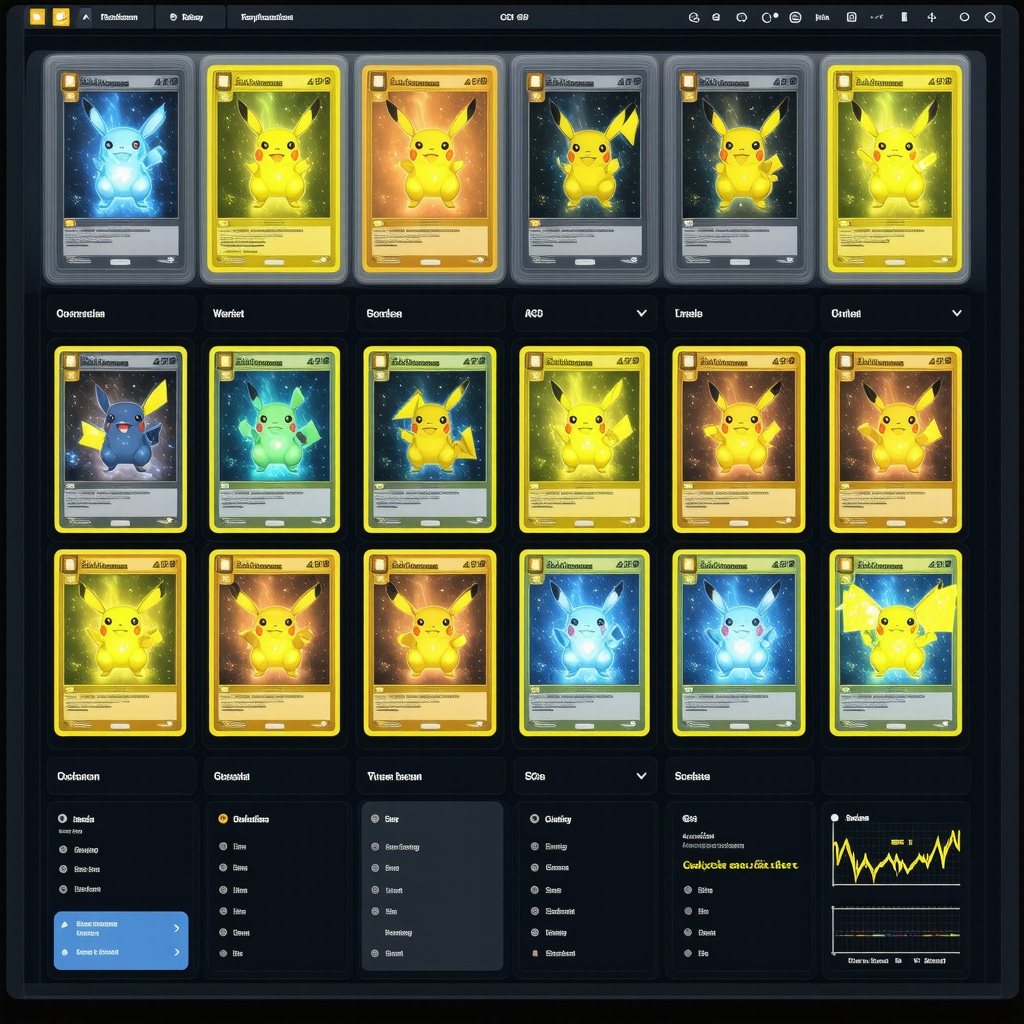

Visualizing the Intersection of Blockchain and AI in Pokémon Card Grading and Market Analytics

Illustrated here is a conceptual interface showcasing real-time blockchain-verified grading certificates alongside AI-generated sentiment heatmaps and auction price trends for CGC 10 Japanese vintage cards. This visualization underscores the transformative potential of integrating secure provenance with predictive analytics to empower sophisticated investment decisions.

Expert Insights & Advanced Considerations

Leveraging Nuanced Grading Differentiators to Optimize Portfolio Value

Understanding the subtle distinctions between CGC Pristine 10 and Gem Mint 10 grades is critical for investors aiming to maximize returns in Japanese vintage and holo rare Pokémon card markets. These fine grading differentials not only affect immediate valuation but also influence long-term liquidity and collector demand. Mastery of these nuances, as detailed in our comprehensive grading guide, empowers strategic acquisition and disposition decisions.

Integrating Blockchain Provenance to Enhance Authenticity and Market Confidence

The adoption of blockchain technology for verifying CGC 10 Japanese card provenance introduces unprecedented transparency and security. By embedding grading certificates and transaction histories into immutable ledgers, investors can mitigate forgery and tampering risks. This innovation also facilitates fractional ownership, broadening access to high-value cards. Keeping abreast of these developments positions collectors advantageously within an evolving ecosystem, as explored in detail within our blockchain and AI convergence analysis.

Harnessing AI-Driven Market Sentiment for Predictive Investment Timing

Artificial intelligence tools that analyze social media, auction chatter, and collector forums provide a multidimensional perspective on market sentiment. When combined with grading data, these insights enable investors to anticipate demand surges or contractions with greater precision. This proactive approach to market timing is essential for maximizing profits and managing portfolio volatility in the dynamic CGC 10 Japanese vintage card segment.

Strategic Acquisition of Underappreciated Trainer Secret Rares for Portfolio Diversification

While iconic Pokémon cards command attention, the often-overlooked CGC 10 Japanese Trainer Secret Rares represent a fertile ground for growth. Their rarity, combined with pristine grading, appeals to competitive play enthusiasts and niche collectors. Prioritizing these cards in acquisition strategies enhances diversification and unlocks hidden value, as thoroughly discussed in our expert insights on Trainer Secret Rares.

Utilizing Algorithmic Portfolio Models to Balance Risk and Optimize Returns

Incorporating CGC 10 Japanese vintage and holo rares into algorithmic investment frameworks allows for the quantification of unique risk-return profiles. By analyzing rarity indices, grade distributions, and liquidity metrics, investors can construct balanced portfolios that reduce volatility and exploit arbitrage opportunities. This advanced methodology is essential for navigating the collectible market’s complexities with discipline and foresight.

Curated Expert Resources

1. “Decoding CGC Grading Standards for Japanese Pokémon Cards” – A definitive resource that dissects CGC’s grading criteria, offering collectors and investors a precise understanding of how condition and authenticity are rigorously assessed. (Read More)

2. “Mastering CGC 10 Japanese Full Art Trainer Secret Rare Insights” – Focuses on the strategic value and grading subtleties of Trainer Secret Rares, an underexplored segment with significant upside potential. (Explore Details)

3. “Exploring Investment Potential of CGC 10 Japanese Vintage Holo Cards” – Comprehensive analyses and market trend reports that equip investors with actionable intelligence on emerging opportunities. (Discover Insights)

4. “Where to Find CGC Gem Mint 10 Japanese Pokémon Cards on eBay” – A practical guide to sourcing authentic high-grade Japanese cards in a secure and transparent manner. (Access Guide)

5. “Unlocking the Value of CGC 10 Japanese Base Set Cards in 2025” – Provides forward-looking insights on key base set cards poised for appreciation, with emphasis on CGC 10 certification impact. (Learn More)

Final Expert Perspective

The landscape of CGC 10 Japanese vintage and holo rare Pokémon card investing demands a sophisticated understanding of grading nuances, technological innovations, and market sentiment dynamics. Pristine condition certification, underpinned by CGC’s rigorous standards, remains a cornerstone of value preservation and growth. Integrating blockchain provenance and AI-driven analytics further elevates the strategic horizon, offering collectors and investors enhanced security and predictive capabilities. Cultivating expertise through vetted resources and community engagement is indispensable for navigating this complex, evolving market. To deepen your mastery and engage with fellow experts, consider exploring comprehensive analyses, participating in discussion forums, or reaching out via our Contact Us page. Your journey into advanced Japanese Pokémon card investment excellence begins here.

The detailed breakdown of CGC 10 Japanese vintage and holo rares in this post really highlights how multifaceted Pokémon card investing has become, blending cultural significance with grading precision. One aspect I find particularly intriguing is the subtle difference between CGC Pristine 10 and Gem Mint 10 grades — this nuance seems to drastically impact both collector demand and long-term value. From my experience, understanding these fine grading distinctions can guide smarter acquisitions, especially when targeting cards like the Japanese Base Set Charizard or those elusive Trainer Secret Rares that often fly under the radar.

What stood out to me was the emphasis on the superior market resilience of CGC 10 Japanese cards compared to their English counterparts, largely due to limited print runs and collector preferences for pristine condition. I’m curious — for those actively building Pokémon card portfolios, how do you balance investing in such high-grade niche Japanese cards versus more mainstream English cards? Has anyone found an effective strategy to optimize portfolio diversity while mitigating the risks associated with fluctuations in regional demand or grading standard changes? It seems leveraging both traditional market analysis and emerging AI-driven sentiment tools might be the key to staying ahead.